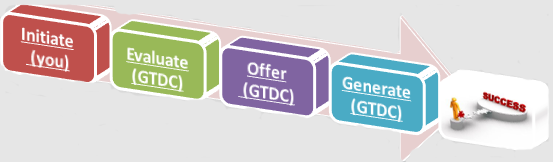

Client Evaluation Process

We have formed working relationships with entities in a number frontier and emerging markets, and we have representatives on the ground in Ethiopia, South Sudan, South Africa, and Saudi Arabia with many more to come. Think global - expand your business and become a major regional, continental, and global player by leveraging investments from private growth capital. This is how it works:

Initiate (you)

You start the process by filling out Client Evaluation Form and submitting it online or filling out the PDF Client Evaluation Form and contacting our local representatives who will guide you through the process or attaching the file and sending it to info@gtdcinc.com. The most important requirement in this part of the process is making sure your business qualifies for financing by ensuring your business’ verifiable revenue is at least one third of the amount of financing you request. Once that is established, we ask you to provide the following documentation:

- Your company’s financial documents – 3 years revenue, bank statements, audit reports, etc.

- Business plan or feasibility study. Although there is no single formula for developing a business plan, this business plan outline gives you an idea of some elements that are consistent throughout all business plans.

Evaluate (GTDC & Partners)

Once we receive your form and confirm that you qualify for our financing, we start reviewing and preparing all supporting documents. Along with our investment banking partners, we evaluate, analyze, and put together a strategy for a successful implementation of financing that fits your unique investment needs.

Offer (GTDC & Partners)

In this part of the process, we offer you a package for your review on our plans to get you the financing and details such as types and amount of financing, schedule and duration of process, associated processing fee, and any other detail that applies to the specific request. Associated processing fee varies depending on the complexity of the project and is a non-refundable fee that covers the cost our partners incur for legal, accounting, research, analysis, presentation and portfolio packaging. The fee can be paid as a lump sum or can be scheduled to be paid in installments that last a few months. Once you review and approve the documents with any changes you make, we then sign an agreement.

Generate (GTDC & Partners)

With the agreement signed, the next and final step is for us to begin the transaction process by generating all the necessary documentation and financial modeling, creating the target list of strategic investors, and approaching, negotiating and closing the contemplated transaction.